12 Smartest Ways to Invest with Minimal Savings

Investing is often perceived as a privilege reserved for the wealthy, but this couldn’t be further from the truth. With technological advancements, increased financial literacy, and a host of accessible investment platforms, even those with minimal savings can begin building wealth. The key lies in starting small, being consistent, and making informed choices. Here’s a comprehensive guide to the smartest ways to invest when you’re working with limited funds.

-

Start with a Mindset Shift

Before diving into the mechanics of investing, it’s important to reframe your thinking. Many people wait until they have “enough” money to invest, but the reality is that starting with what you have—even if it’s just $10 or $50—can set the foundation for financial growth. The power of compound interest means that even small, regular investments can grow significantly over time.

-

Build an Emergency Fund First

While this isn’t a direct investment, building an emergency fund is a critical first step. Aim to set aside three to six months’ worth of living expenses in a high-yield savings account. This fund acts as a financial cushion, preventing you from dipping into your investments during a crisis. High-yield savings accounts offer better interest than traditional savings accounts and can help your money grow safely.

-

Leverage Micro-Investing Platforms

Micro-investing platforms like Acorns, Stash, and Robinhood allow users to start investing with just a few dollars. These apps often let you invest your spare change from everyday purchases. For example, if you buy a coffee for $2.75, the app rounds it up to $3 and invests the extra $0.25. Over time, this can add up significantly. Click here

-

Pros:

- Low minimum investment.

- Automated investing.

- Easy to use.

-

Cons:

- Limited investment options.

- Fees can be proportionally high on small balances.

-

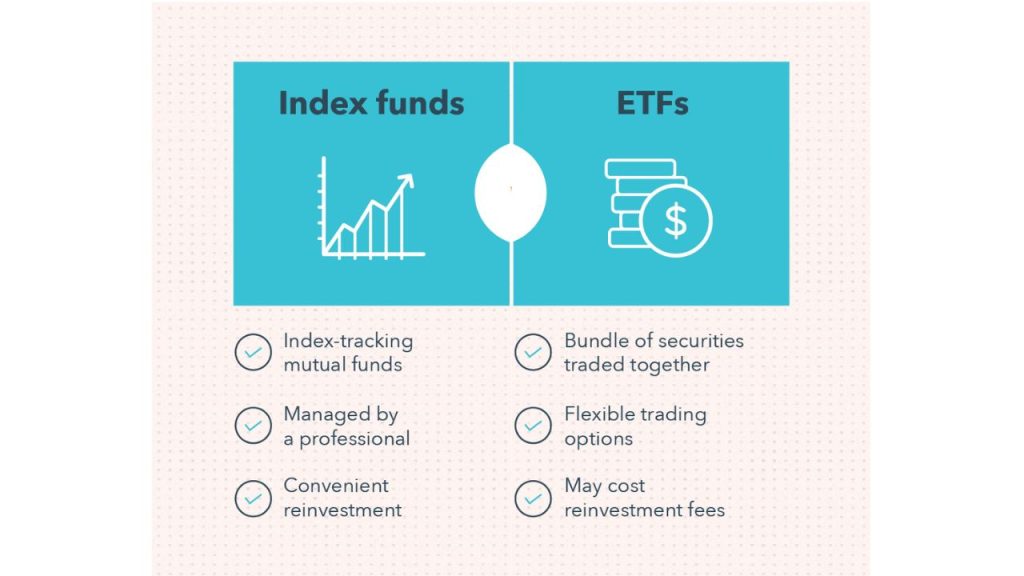

Invest in ETFs and Index Funds

Exchange-Traded Funds (ETFs) and index funds are excellent options for those with minimal savings. They provide diversification by pooling money into a broad mix of stocks, which reduces risk. Many brokerage firms like Fidelity, Vanguard, and Charles Schwab offer ETFs with no minimum investment.

For example, investing in an S&P 500 ETF gives you exposure to 500 of the largest companies in the U.S., spreading out your risk and improving your chances of consistent returns.

-

Why they’re smart:

- Diversified investment.

- Low fees.

- Historically solid returns.

Fractional shares allow you to buy a portion of a stock rather than the whole share. This is perfect if you want to invest in companies like Amazon or Google, whose full share prices are often in the thousands. Platforms like Fidelity, Robinhood, and Cash App now offer this feature.

This strategy enables you to start investing in high-performing companies with just a few dollars, allowing for portfolio growth even with small contributions.

-

Automate Your Investments

One of the smartest ways to invest with minimal savings is to automate your investments. Set up recurring transfers to your investment account, even if it’s only $10 a week. This approach, known as dollar-cost averaging, smooths out market volatility over time and builds the discipline of regular investing.

Several apps and brokerages allow you to automate your deposits and investments, making the process seamless.

-

Take Advantage of Employer Retirement Plans

If your employer offers a 401(k) or similar retirement plan, take full advantage of it—especially if there is a company match. Even contributing 1-2% of your income can make a difference over the long term.

-

Key benefits:

- Tax-deferred growth.

- Employer contributions (free money).

- Easy payroll deductions.

If a 401(k) isn’t available, consider opening an IRA (Individual Retirement Account), which you can start with minimal funds through platforms like Betterment, Vanguard, or Fidelity.

-

Invest in Yourself

Investing in your skills, education, and personal growth often yields the highest returns—especially when your savings are limited. Online courses, certifications, and books can help you improve your earning potential and financial literacy. Platforms like Coursera, Udemy, and LinkedIn Learning offer affordable or free resources.

-

Why it’s smart:

- Enhances earning capacity.

- Improves career prospects.

- Builds confidence and knowledge.

-

Use Robo-Advisors

Robo-advisors like Betterment, Wealth front, and SoFi Automated Investing provide algorithm-driven investment advice with minimal fees and low account minimums. They help you manage a diversified portfolio, automatically rebalance it, and reinvest dividends.

This is ideal for beginners who want hands-off investing with professional-grade advice tailored to their goals and risk tolerance.

-

Explore High-Interest Savings and CDs

While not traditional “investments,” high-yield savings accounts and Certificates of Deposit (CDs) can be smart places to park your money while it grows safely. Many online banks offer interest rates significantly higher than those of traditional banks.

-

Pros:

- Low risk.

- FDIC insured.

- Great for short-term goals.

Consider using these as steppingstones while you build your investment knowledge and confidence.

-

Practice Consistency Over Perfection

Consistency is more important than timing the market or choosing the “perfect” stock. Make investing a habit. Even if markets dip, continuing to invest regularly means you’ll benefit from lower prices and ride the eventual recovery.

Set achievable goals, track your progress, and celebrate small wins. This builds momentum and long-term discipline.

-

Avoid High-Risk or “Get Rich Quick” Schemes

When you’re starting with minimal savings, it’s tempting to go for high-risk investments like penny stocks, cryptocurrencies, or speculative trading. While there can be gains, these also carry high volatility and risk of total loss. Click here

Instead, focus on slow, steady growth through diversified, reputable investments. As your financial foundation strengthens, you can allocate a small percentage of your portfolio to higher-risk ventures if desired.

Final Thoughts

Investing with minimal savings is not only possible—it’s a smart move that sets the foundation for long-term financial freedom. With the abundance of tools and platforms available today, anyone can start investing with just a few dollars. The key lies in:

- Starting as early as possible.

- Investing consistently.

- Choosing diversified, low-cost investment options.

- Continuously educating yourself.

No matter how small your initial investment, what matters most is taking that first step. Time and discipline are your biggest allies. With patience and persistence, even the smallest investments can grow into substantial wealth over time.