15 Passive Income Business Ideas

Achieving financial freedom is a goal that many aspire to, and passive income is a powerful way to make this dream a reality. Passive income refers to earnings generated with minimal ongoing effort, allowing you to build wealth and maintain financial stability even while you sleep. Unlike traditional income sources that require consistent active work, passive income streams offer the flexibility and freedom to live life on your terms.

In this article, we’ll explore various passive income business ideas that can help you grow wealth and achieve financial freedom.

-

Rental Properties

Investing in rental properties is a classic and proven method of generating passive income. Purchasing real estate and renting it out provides a steady stream of income each month. With proper management, this can become a reliable long-term income source.

Steps to Get Started:

Research Markets: Identify high-demand areas with potential for appreciation.

Secure Financing: Obtain a mortgage or use savings to purchase property.

Hire a Property Manager: Delegate day-to-day responsibilities to make it truly passive.

Benefits of rental properties include tax advantages and the potential for long-term equity growth. Platforms like Airbnb also make short-term rental management easier and more lucrative in certain markets.

-

Dividend Stocks

Investing in dividend-paying stocks is another excellent way to earn passive income. These stocks pay a portion of the company’s earnings to shareholders regularly.

Steps to Get Started:

Open a Brokerage Account: Use platforms like Fidelity, Vanguard, or Robinhood.

Research Stocks: Look for established companies with a history of consistent dividend payouts.

Reinvest Dividends: Use dividend reinvestment plans (DRIPs) to compound earnings.

Dividend stocks are a low-maintenance way to build wealth over time, especially when combined with a long-term investment strategy.

-

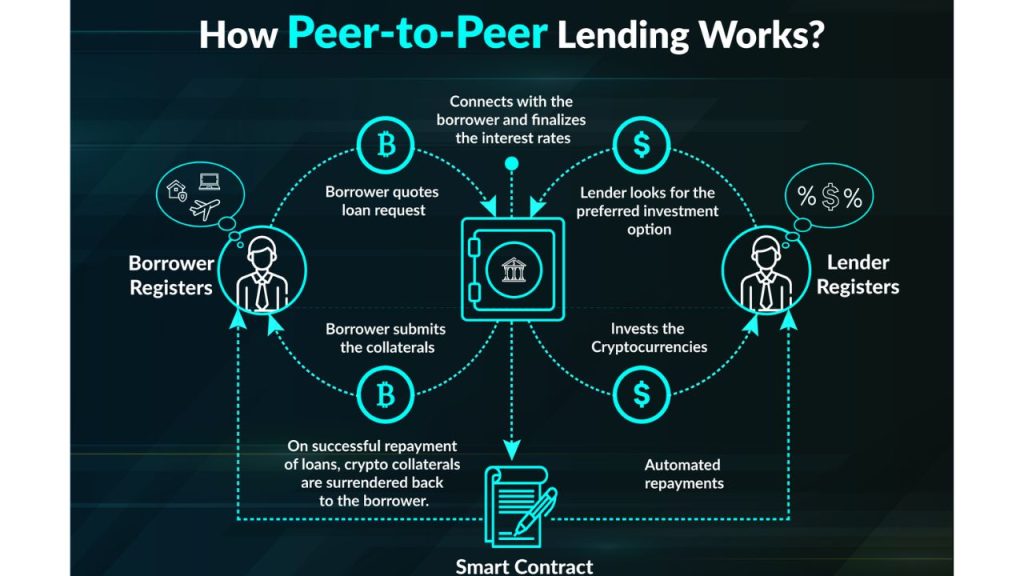

Peer-to-Peer Lending

Peer-to-peer (P2P) lending platforms allow you to lend money to individuals or small businesses in exchange for interest payments. Platforms like Lending Club maybe helpful to get started.

Steps to Get Started:

Choose a Platform: Research and select a reputable P2P lending platform.

Diversify Investments: Spread your money across multiple borrowers to reduce risk.

Monitor Returns: Periodically review performance and reinvest earnings.

While P2P lending can offer higher returns than traditional savings accounts, it’s essential to be mindful of the associated risks.

-

Creating an Online Course

If you have expertise in a specific field, creating and selling an online course can be a highly profitable passive income stream. Platforms like Udemy, Teachable, and Skill share make it easy to upload and market your course.

Steps to Get Started:

Identify a Niche: Focus on a subject you’re passionate about and knowledgeable in.

Develop Content: Create video lessons, downloadable resources, and quizzes.

Market Your Course: Use social media, blogs, and email lists to attract students.

Once the course is created, it requires minimal maintenance while generating income from student enrollments.

-

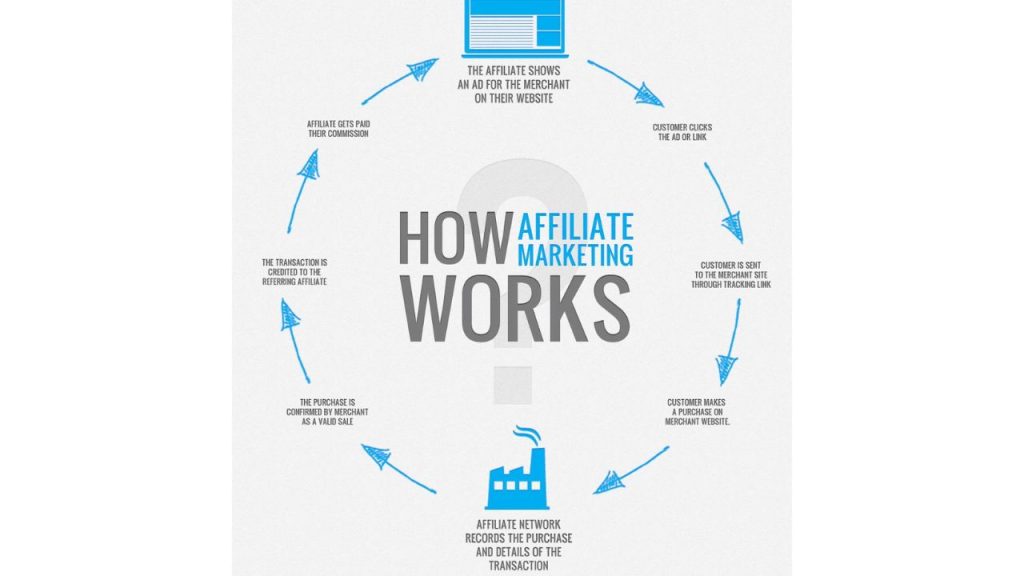

Affiliate Marketing

Affiliate marketing involves promoting products or services and earning a commission for every sale made through your referral. This business model works well for bloggers, YouTubers, and social media influencers.

Steps to Get Started:

Choose a Niche: Focus on a specific area to build a targeted audience.

Join Affiliate Programs: Sign up with platforms like Amazon Associates, or CJ Affiliate.

Promote Products: Use blogs, videos, and social media posts to recommend products.

Affiliate marketing can scale significantly as your audience grows, making it a lucrative passive income source.

-

E-books and Self-Publishing

Writing and publishing an e-book is another great way to generate passive income. Platforms like Amazon Kindle Direct Publishing (KDP) allow authors to reach a global audience without needing a traditional publisher.

Steps to Get Started:

Write Your Book: Choose a topic or genre you’re passionate about.

Format and Design: Use tools like Canva or hire professionals for editing and cover design.

Publish and Market: Upload your book to platforms like Amazon and promote it through social media.

Once published, your e-book can continue earning royalties for years with minimal additional effort.

-

Print-on-Demand Businesses

Print-on-demand (POD) businesses allow you to design custom products like T-shirts, mugs, and phone cases. You only pay for production when a sale is made, eliminating the need for inventory.

Steps to Get Started:

Choose a Platform: Use sites like Printful, Teespring, or Redbubble.

Create Designs: Use design tools like Canva or Adobe Illustrator.

Market Your Products: Leverage social media and paid ads to reach your target audience.

POD businesses are low-risk and highly scalable, making them an attractive passive income option.

-

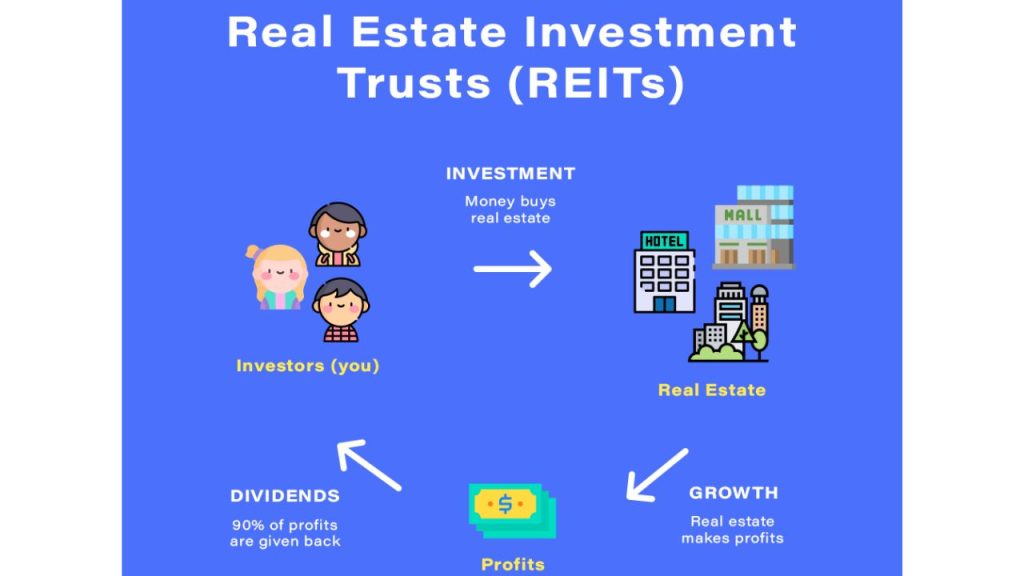

Investing in REITs

Real Estate Investment Trusts (REITs) allow you to invest in real estate without owning physical property. REITs are companies that manage income-generating real estate and pay dividends to investors. Click here

Steps to Get Started:

Research REITs: Choose between equity, mortgage, or hybrid REITs.

Invest Through a Broker: Purchase REIT shares via a brokerage account.

Reinvest Dividends: Use DRIPs to grow your investment over time.

REITs provide a hassle-free way to benefit from real estate’s earning potential without the challenges of property management.

-

YouTube Channel

Creating a YouTube channel can be a lucrative passive income source once you build a sizable audience. Ad revenue, sponsorships, and affiliate marketing can all contribute to earnings.

Steps to Get Started:

Choose a Niche: Focus on content that aligns with your interests and audience demand.

Create High-Quality Videos: Need to Invest in good equipment and editing software.

Monetize: Enable ads through YouTube’s Partner Program and explore additional revenue streams.

Consistent posting and engaging content are key to growing your channel and income.

-

Stock Photography and Videos

If you have photography or videography skills, selling stock photos and videos can be a passive income goldmine. For this you can use platforms like Shutterstock, Adobe Stock, and Getty Images allow creators to earn royalties.

Steps to Get Started:

Capture High-Quality Content: Focus on versatile themes like travel, business, or lifestyle.

Upload to Platforms: Submit your work to multiple stock libraries.

Optimize Metadata: Use relevant keywords to make your content discoverable.

Once uploaded, your photos and videos can generate income for years.

-

Build a Mobile App

Creating a mobile app can be a lucrative passive income source if it provides value or entertainment. Whether it’s a game, utility tool, or educational app, the possibilities are endless.

Steps to Get Started:

Develop or Outsource: Build the app yourself or hire a developer.

Monetize: Use ads, in-app purchases, or a subscription model.

Market: Promote your app through app stores, social media, and ads.

Apps that solve specific problems or entertain users have high earning potential.

-

Sell Digital Products

Digital products like templates, graphics, and software can generate significant passive income. Platforms like Etsy, Gumroad, and Shopify make it easy to sell these items online.

Steps to Get Started:

Create Products: Design templates, printables, or software tools.

List on Platforms: Upload your products and set pricing.

Automate Delivery: Use digital delivery systems to fulfill orders automatically.

Once created, digital products require little maintenance while providing ongoing revenue.

-

Investing in Index Funds

Index funds are a low-maintenance way to grow wealth and earn passive income. These funds track the performance of a market index, such as the S&P 500, and offer diversification.

Steps to Get Started:

Open an Investment Account: Use platforms like Vanguard, Schwab, or Fidelity.

Choose Funds: Look for low-cost index funds with good track records.

Invest Regularly: Use dollar-cost averaging to grow your portfolio steadily.

Index funds are ideal for beginners and seasoned investors seeking long-term growth.

-

Vending Machines

Owning and operating vending machines can generate consistent passive income with minimal effort. Placing machines in high-traffic areas ensures steady sales.

Steps to Get Started:

Purchase Machines: Buy new or used vending machines.

Find Locations: Partner with businesses to place your machines.

Restock Periodically: Replenish inventory and collect earnings.

With proper placement, vending machines can offer a high return on investment.

-

Automated Dropshipping Store

Dropshipping allows you to sell products online without holding inventory. Automated tools and outsourcing can make this business model passive.

Steps to Get Started:

Choose a Niche: You need to focus on trending or evergreen products.

Set Up a Store: You can Use platforms like Shopify or WooCommerce.

Automate Fulfillment: Partner with suppliers who handle shipping directly.

Effective marketing and automation are key to running a successful dropshipping business.

Final Thoughts

Building a passive income may streams takes time, effort, and sometimes upfront investment. However, the rewards are well worth it, as they provide financial freedom and security. Start with one or two ideas that align with your skills and interests, and scale from there. With persistence and strategic planning, passive income can pave the way to a wealthier and more fulfilling life. Click here