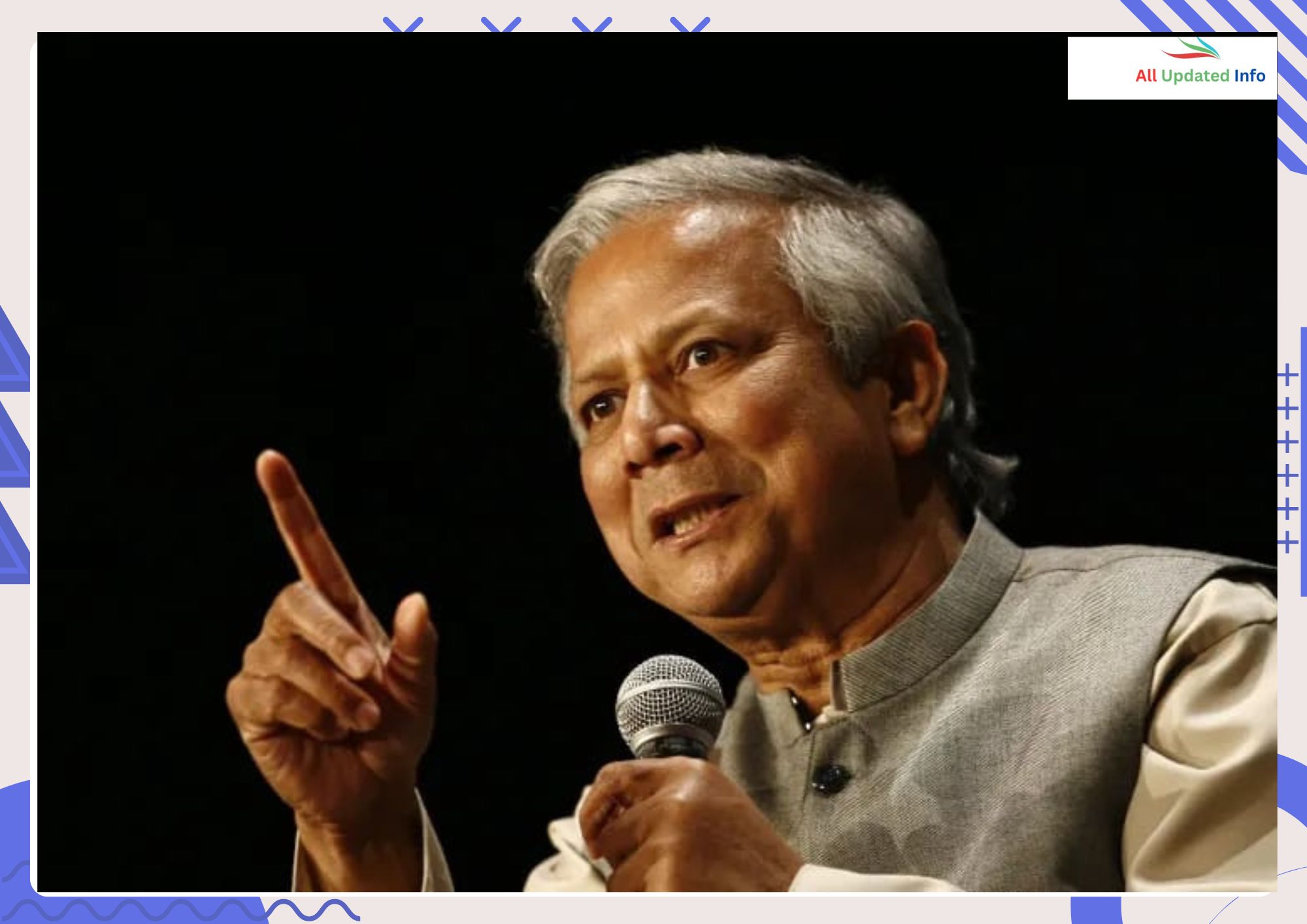

Professor Dr Muhammad Yunus the Founder of Grameen Bank

Dr. Muhammad Yunus, often referred to as the “Father of Microfinance,” is a celebrated Bangladeshi economist, social entrepreneur, and the founder of Grameen Bank. His groundbreaking work in alleviating poverty earned him the Nobel Peace Prize in 2006. This article explores his life journey, his education, achievements, the founding of Grameen Bank, and his legacy.

Early Life and Education:

Dr. Muhammad Yunus was born on June 28, 1940, in the village of Bathua, in Chittagong, Bangladesh, then part of British India. He grew up in a modest family, with his father working as a jeweler. Yunus displayed exceptional academic potential from a young age, which set him on a path to becoming a global leader in economic reform and poverty reduction.

After completing his secondary education, Yunus attended Chittagong College and later the University of Dhaka, where he earned his bachelor’s and master’s degrees in economics. He then received a Fulbright scholarship to study in the United States, where he earned his Ph.D. in Economics from Vanderbilt University in 1971.

Academic Career and the Genesis of Microcredit:

Upon his return to Bangladesh, Yunus began his academic career as an economics professor at Chittagong University. It was during this time, in the 1970s, that Bangladesh was grappling with severe poverty and the aftermath of the Bangladesh Liberation War. Yunus was deeply moved by the struggles of impoverished communities and began searching for ways to use his knowledge to make a difference.

While visiting a village near his university, Yunus met a woman who made bamboo stools but struggled to sustain her business due to the high-interest loans she had to take from local moneylenders. Seeing this, Yunus began lending small amounts of money from his pocket to these villagers. This experience led him to realize that access to small, affordable loans could be a powerful tool for empowering the poor to start or expand businesses, build income, and break out of the cycle of poverty.

Founding of Grameen Bank:

In 1976, Yunus formalized his ideas into a pilot project known as the Grameen Bank Project. “Grameen” means “rural” in Bengali, reflecting the bank’s focus on rural communities. His concept of microcredit—small loans provided without collateral to the poor—was a radical departure from traditional banking, which often excluded low-income individuals. Yunus’s model emphasized trust and community support, allowing borrowers to access loans through group-based lending and encouraging responsibility among group members.

By 1983, the project had shown such success that it was transformed into a full-fledged, independent bank—Grameen Bank. Its mission was simple yet revolutionary: provide financial services to the poor, especially women, who could use the funds to start small businesses and improve their livelihoods. The majority of Grameen Bank’s borrowers were women, and the model relied on empowering women to achieve economic independence, thereby improving the welfare of their entire families and communities.

Achievements and Recognition:

The success of Grameen Bank and its microcredit model gained international attention. By the early 2000s, Grameen Bank had millions of borrowers across Bangladesh, with a repayment rate close to 97%. The bank’s methods proved that the poor were indeed creditworthy and could repay loans when given the opportunity.

In 2006, Professor Muhammad Yunus and Grameen Bank were jointly awarded the Nobel Peace Prize for their efforts to create economic and social development from below. The Nobel Committee recognized Yunus’s work as a significant contribution to peace and poverty alleviation, stating that sustainable peace could not be achieved without reducing poverty and empowering the economically marginalized. Dr. Yunus became the first Bangladeshi to receive the Nobel Peace Prize, a moment of immense pride for his country and a major recognition of the potential for microfinance to drive social change.

Expanding Impact and Other Ventures:

Yunus’s work did not stop with Grameen Bank. He used his platform to advocate for “social business,” a model of business dedicated to solving social issues rather than maximizing profits. Through Grameen-affiliated organizations, he developed partnerships with international corporations to create social businesses addressing various challenges, from health and education to sanitation and renewable energy.

Some of these initiatives include:

Grameen Shakti: A company that focuses on providing renewable energy to rural areas in Bangladesh.

Grameen Danone: A joint venture with Danone to produce and distribute affordable, nutrient-fortified yogurt for malnourished children.

Grameen Veolia Water: A partnership with Veolia to provide safe drinking water to rural areas.

Yunus’s vision for social business has inspired countless entrepreneurs worldwide, and he has become a global advocate for socially conscious entrepreneurship. He has authored several books, including Banker to the Poor, creating a World Without Poverty, and A World of Three Zeros, which outline his philosophy and vision for a world free of poverty, unemployment, and environmental harm.

Legacy and Influence:

Today, Dr. Yunus is regarded as one of the most influential figures in social entrepreneurship and poverty alleviation. His microfinance model has been replicated worldwide, providing millions with access to financial services and demonstrating that the private sector can play a transformative role in development.

In addition to the Nobel Peace Prize, Yunus has received numerous honors, including the Presidential Medal of Freedom from the United States and the Congressional Gold Medal. His work has inspired a new generation of social entrepreneurs and has led to the establishment of microcredit programs globally.

Challenges and Controversies:

Despite his remarkable achievements, Yunus has faced challenges and controversies. In the early 2010s, he faced scrutiny in Bangladesh, particularly from political entities. Accusations arose regarding the governance of Grameen Bank, leading to his removal as Managing Director. However, Yunus has remained an influential figure, continuing his work through the Yunus Centre and other organizations dedicated to poverty reduction and social business.

Conclusion:

Professor Dr. Muhammad Yunus’s legacy is built on a simple but powerful belief: that poverty is not created by the poor but by social and economic systems that deny them opportunities. Through Grameen Bank and his tireless advocacy for social business, Yunus has proven that empowering the impoverished through microfinance can lead to significant, lasting social change. His contributions to social finance and economic inclusion have transformed millions of lives and provided a model for sustainable development that continues to inspire and guide global efforts to end poverty. Click here